The All Ordinaries Index (XAO) provides a benchmark for the “whole” Australian sharemarket.

The index consists of the 500 largest companies listed on the ASX. The market capitalisation cutoff for initial entry is ~$200 million and together the constituents account for over three quarters of the Australian sharemarket.

Investors still regularly use the All Ords as a benchmark for two reasons:

- It contains all sized companies except micro-caps

- It was Australia’s primary index for over 20 years until its retirement in 2000

No Exchange Traded Funds (ETFs) are available that track the performance of the All Ordinaries.

IMPORTANT

IMPORTANTAllOrdslist.com doesn’t provide share price data.

The best website is Market Index.

They have current ASX share prices, company charts and announcements, dividend data, directors’ transactions and broker consensus.

How are All Ords companies selected?

Constituents are selected by a committee from Standard & Poor’s (S&P) and the Australian Securities Exchange (ASX).

All companies listed on the Australian Securities Exchange (ASX) are ranked by market capitalisation. Exchange traded funds and Listed Investment Companies (LICs) are ignored. The 500 largest companies are then eligible for inclusion in the index. There’s no liquidity requirement.

Rebalances are conducted annually in March. Unlike other indices, if a company is removed from the index between rebalances (due to a delisting, merger, etc.) a replacement is not added until the next rebalance date.

Skip to the All Ords: Sector Breakdown | PE & Yield | ETF

Skip to the All Ords: Sector Breakdown | PE & Yield | ETF

Top 500 List (28 April 2021)

Click here for the current Share Prices (and Stock Charts)

The 500 largest companies by market capitalisation (includes ETFs & LICs) and not S&P constituents.

| Code | Company |

|---|---|

| 360 | LIFE360 Inc |

| 3DP | Pointerra Ltd |

| A200 | Betashares Australia 200 ETF |

| A2M | The a2 Milk Company Ltd |

| A4N | Alpha Hpa Ltd |

| AAA | Betashares Australian High Interest Cash ETF |

| AAC | Australian Agricultural Company Ltd |

| ABB | Aussie Broadband Ltd |

| ABC | Adbri Ltd |

| ABP | Abacus Property Group |

| ABR | American Pacific Borates Ltd |

| ABY | Adore Beauty Group Ltd |

| AD8 | Audinate Group Ltd |

| ADH | Adairs Ltd |

| ADI | Apn Industria REIT |

| ADN | Andromeda Metals Ltd |

| ADO | Anteotech Ltd |

| ADT | Adriatic Metals Plc |

| AEF | Australian Ethical Investment Ltd |

| AFG | Australian Finance Group Ltd |

| AFI | Australian Foundation Investment Company Ltd |

| AFP | Aft Pharmaceuticals Ltd |

| AGG | Anglogold Ashanti Ltd |

| AGL | AGL Energy Ltd |

| AHY | Asaleo Care Ltd |

| AIA | Auckland International Airport Ltd |

| AIZ | Air New Zealand Ltd |

| AKP | Audio Pixels Holdings Ltd |

| ALC | Alcidion Group Ltd |

| ALD | Ampol Ltd |

| ALG | Ardent Leisure Group Ltd |

| ALK | Alkane Resources Ltd |

| ALL | Aristocrat Leisure Ltd |

| ALQ | Als Ltd |

| ALU | Altium Ltd |

| ALX | Atlas Arteria |

| AMA | AMA Group Ltd |

| AMC | Amcor Plc |

| AMI | Aurelia Metals Ltd |

| AMP | AMP Ltd |

| ANN | Ansell Ltd |

| ANZ | Australia and New Zealand Banking Group Ltd |

| AOF | Australian Unity Office Fund |

| APA | APA Group |

| APE | Eagers Automotive Ltd |

| API | Australian Pharmaceutical Industries Ltd |

| APL | Antipodes Global Investment Company Ltd |

| APT | Afterpay Ltd |

| APX | Appen Ltd |

| AQR | Apn Convenience Retail REIT |

| AQZ | Alliance Aviation Services Ltd |

| ARB | ARB Corporation Ltd |

| ARF | Arena REIT |

| ARG | Argo Investments Ltd |

| ART | Airtasker Ltd |

| ASB | Austal Ltd |

| ASG | Autosports Group Ltd |

| ASIA | Betashares Asia Technology Tigers ETF |

| ASM | Australian Strategic Materials Ltd |

| AST | Ausnet Services Ltd |

| ASX | ASX Ltd |

| AUB | AUB Group Ltd |

| AUI | Australian United Investment Company Ltd |

| AVN | Aventus Group |

| AVZ | AVZ Minerals Ltd |

| AWC | Alumina Ltd |

| AX1 | Accent Group Ltd |

| AZJ | Aurizon Holdings Ltd |

| BAP | Bapcor Ltd |

| BBN | Baby Bunting Group Ltd |

| BCK | Brockman Mining Ltd |

| BEN | Bendigo and Adelaide Bank Ltd |

| BET | Betmakers Technology Group Ltd |

| BFG | Bell Financial Group Ltd |

| BGA | Bega Cheese Ltd |

| BGL | Bellevue Gold Ltd |

| BGP | Briscoe Group Australasia Ltd |

| BHP | BHP Group Ltd |

| BILL | Ishares Core Cash ETF |

| BIN | Bingo Industries Ltd |

| BKI | BKI Investment Company Ltd |

| BKL | Blackmores Ltd |

| BKW | Brickworks Ltd |

| BLD | Boral Ltd |

| BLX | Beacon Lighting Group Ltd |

| BOQ | Bank of Queensland Ltd |

| BPT | Beach Energy Ltd |

| BRG | Breville Group Ltd |

| BRN | Brainchip Holdings Ltd |

| BSL | Bluescope Steel Ltd |

| BTH | Bigtincan Holdings Ltd |

| BVS | Bravura Solutions Ltd |

| BWP | BWP Trust |

| BWX | BWX Ltd |

| BXB | Brambles Ltd |

| CAJ | Capitol Health Ltd |

| CAR | Carsales.com Ltd |

| CAT | Catapult Group International Ltd |

| CBA | Commonwealth Bank of Australia |

| CCL | Coca-Cola Amatil LtdSuspended |

| CCP | Credit Corp Group Ltd |

| CCX | City Chic Collective Ltd |

| CDA | Codan Ltd |

| CEN | Contact Energy Ltd |

| CGC | Costa Group Holdings Ltd |

| CGF | Challenger Ltd |

| CHC | Charter Hall Group |

| CHN | Chalice Mining Ltd |

| CIA | Champion Iron Ltd |

| CIM | Cimic Group Ltd |

| CIN | Carlton Investments Ltd |

| CIP | Centuria Industrial REIT |

| CKF | Collins Foods Ltd |

| CLW | Charter Hall Long Wale REIT |

| CMM | Capricorn Metals Ltd |

| CMW | Cromwell Property Group |

| CNI | Centuria Capital Group |

| CNU | Chorus Ltd |

| COE | Cooper Energy Ltd |

| COF | Centuria Office REIT |

| COH | Cochlear Ltd |

| COL | Coles Group Ltd |

| CPU | Computershare Ltd |

| CQE | Charter Hall Social Infrastructure REIT |

| CQR | Charter Hall Retail REIT |

| CRED | Betashares Australian Investment Grade Corporate Bond ETF |

| CRN | Coronado Global Resources Inc |

| CSL | CSL Ltd |

| CSR | CSR Ltd |

| CTD | Corporate Travel Management Ltd |

| CTT | Cettire Ltd |

| CUV | Clinuvel Pharmaceuticals Ltd |

| CVN | Carnarvon Petroleum Ltd |

| CWN | Crown Resorts Ltd |

| CWP | Cedar Woods Properties Ltd |

| CWY | Cleanaway Waste Management Ltd |

| CXL | CALIX Ltd |

| DBI | Dalrymple Bay Infrastructure Ltd |

| DDH | DDH1 Ltd |

| DDR | Dicker Data Ltd |

| DEG | De Grey Mining Ltd |

| DHG | Domain Holdings Australia Ltd |

| DJRE | SPDR Dow Jones Global Real Estate Fund |

| DJW | Djerriwarrh Investments Ltd |

| DMP | Domino's PIZZA Enterprises Ltd |

| DOW | Downer Edi Ltd |

| DRR | Deterra Royalties Ltd |

| DTL | Data#3 Ltd |

| DUB | Dubber Corporation Ltd |

| DUI | Diversified United Investment Ltd |

| DXS | Dexus |

| EBO | Ebos Group Ltd |

| ECX | Eclipx Group Ltd |

| EHE | Estia Health Ltd |

| EHL | Emeco Holdings Ltd |

| ELD | Elders Ltd |

| ELO | Elmo Software Ltd |

| EML | EML Payments Ltd |

| EMR | Emerald Resources NL |

| EOF | Ecofibre Ltd |

| EOS | Electro Optic Systems Holdings Ltd |

| EQT | EQT Holdings Ltd |

| ERA | Energy Resources of Australia Ltd |

| ERD | Eroad Ltd |

| ETHI | Betashares Global Sustainability Leaders ETF |

| EVN | Evolution Mining Ltd |

| EVT | Event Hospitality and Entertainment Ltd |

| FAIR | Betashares Australian Sustainability Leaders ETF |

| FBU | Fletcher Building Ltd |

| FCL | Fineos Corporation Holdings Plc |

| FDV | Frontier Digital Ventures Ltd |

| FGG | Future Generation Global Investment Company Ltd |

| FGX | Future Generation Investment Company Ltd |

| FLN | Freelancer Ltd |

| FLT | Flight Centre Travel Group Ltd |

| FMG | Fortescue Metals Group Ltd |

| FPH | Fisher & Paykel Healthcare Corporation Ltd |

| FSF | Fonterra Shareholders' Fund |

| GCI | Gryphon Capital Income Trust |

| GDI | GDI Property Group |

| GDX | Vaneck Vectors Gold Miners ETF |

| GEM | G8 Education Ltd |

| GMA | Genworth Mortgage Insurance Australia Ltd |

| GMG | Goodman Group |

| GNC | Graincorp Ltd |

| GNE | Genesis Energy Ltd |

| GOLD | ETFs Metal Securities Australia Ltd |

| GOR | Gold Road Resources Ltd |

| GOZ | Growthpoint Properties Australia |

| GPT | GPT Group |

| GRR | Grange Resources Ltd |

| GUD | G.U.D. Holdings Ltd |

| GWA | GWA Group Ltd |

| GXY | Galaxy Resources Ltd |

| HACK | Betashares Global Cybersecurity ETF |

| HBRD | Betashares Active Australian Hybrids Fund (Managed Fund) |

| HDN | Homeco Daily Needs REIT |

| HGH | Heartland Group Holdings Ltd |

| HLS | Healius Ltd |

| HM1 | Hearts and Minds Investments Ltd |

| HMC | Home Consortium |

| HPI | Hotel Property Investments |

| HSN | Hansen Technologies Ltd |

| HT1 | HT&E Ltd |

| HTA | Hutchison Telecommunications (Australia) Ltd |

| HUB | HUB24 Ltd |

| HUM | Humm Group Ltd |

| HVN | Harvey Norman Holdings Ltd |

| HYGG | Hyperion GBL Growth Companies Fund (Managed Fund) |

| IAA | Ishares Asia 50 ETF |

| IAF | Ishares Core Composite Bond ETF |

| IAG | Insurance Australia Group Ltd |

| IAP | Irongate Group |

| IDX | Integral Diagnostics Ltd |

| IEL | Idp Education Ltd |

| IEM | Ishares MSCI Emerging Markets ETF |

| IEU | Ishares Europe ETF |

| IFL | IOOF Holdings Ltd |

| IFM | Infomedia Ltd |

| IFRA | Vaneck Vectors Ftse Global Infrastructure (Hedged) ETF |

| IFT | Infratil Ltd |

| IGO | IGO Ltd |

| IHVV | Ishares S&P 500 Aud Hedged ETF |

| IJP | Ishares MSCI Japan ETF |

| ILC | Ishares S&P/ASX 20 ETF |

| ILU | Iluka Resources Ltd |

| IMD | IMDEX Ltd |

| IMU | Imugene Ltd |

| INA | Ingenia Communities Group |

| ING | Inghams Group Ltd |

| INR | Ioneer Ltd |

| IOO | Ishares Global 100 ETF |

| IOZ | Ishares Core S&P/ASX 200 ETF |

| IPH | IPH Ltd |

| IPL | Incitec Pivot Ltd |

| IRE | Iress Ltd |

| IRI | Integrated Research Ltd |

| ISX | Isignthis LtdSuspended |

| IVC | Invocare Ltd |

| IVE | Ishares MSCI Eafe ETF |

| IVV | Ishares S&P 500 ETF |

| IXJ | Ishares Global Healthcare ETF |

| JBH | JB Hi-Fi Ltd |

| JHG | Janus Henderson Group Plc |

| JHX | James Hardie Industries Plc |

| JIN | Jumbo Interactive Ltd |

| JLG | Johns LYNG Group Ltd |

| JMS | Jupiter Mines Ltd |

| KGN | Kogan.com Ltd |

| KKC | KKR Credit Income Fund |

| KMD | Kathmandu Holdings Ltd |

| LEP | Ale Property Group |

| LFG | Liberty Financial Group |

| LFS | Latitude Group Holdings Ltd |

| LGL | Lynch Group Holdings Ltd |

| LIC | Lifestyle Communities Ltd |

| LLC | Lendlease Group |

| LNK | Link Administration Holdings Ltd |

| LOV | Lovisa Holdings Ltd |

| LSF | L1 Long Short Fund Ltd |

| LTR | Liontown Resources Ltd |

| LYC | Lynas Rare EARTHS Ltd |

| MAH | Macmahon Holdings Ltd |

| MAQ | Macquarie Telecom Group Ltd |

| MCR | Mincor Resources NL |

| MCY | Mercury NZ Ltd |

| MEZ | Meridian Energy Ltd |

| MFF | MFF Capital Investments Ltd |

| MFG | Magellan Financial Group Ltd |

| MGF | Magellan Global Fund |

| MGH | Maas Group Holdings Ltd |

| MGOC | Magellan Global Fund (Open Class) (Managed Fund) |

| MGR | Mirvac Group |

| MGX | Mount Gibson Iron Ltd |

| MHH | Magellan High Conviction Trust |

| MICH | Magellan Infrastructure Fund (Currency Hedged)(Managed Fund) |

| MIN | Mineral Resources Ltd |

| MIR | Mirrabooka Investments Ltd |

| MLT | Milton Corporation Ltd |

| MMM | Marley Spoon AG |

| MMS | Mcmillan Shakespeare Ltd |

| MND | Monadelphous Group Ltd |

| MNF | MNF Group Ltd |

| MNY | MONEY3 Corporation Ltd |

| MOE | Moelis Australia Ltd |

| MP1 | Megaport Ltd |

| MPL | Medibank Private Ltd |

| MQG | Macquarie Group Ltd |

| MSB | Mesoblast Ltd |

| MTS | Metcash Ltd |

| MVA | Vaneck Vectors Australian Property ETF |

| MVP | Medical Developments International Ltd |

| MVW | Vaneck Vectors Australian EQUAL Weight ETF |

| MXT | MCP Master Income Trust |

| MYS | Mystate Ltd |

| MYX | Mayne Pharma Group Ltd |

| NAB | National Australia Bank Ltd |

| NAN | Nanosonics Ltd |

| NBI | NB Global Corporate Income Trust |

| NCK | Nick Scali Ltd |

| NCM | Newcrest Mining Ltd |

| NDQ | Betashares Nasdaq 100 ETF |

| NEA | Nearmap Ltd |

| NEC | Nine Entertainment Co. Holdings Ltd |

| NHC | New Hope Corporation Ltd |

| NHF | Nib Holdings Ltd |

| NIC | Nickel Mines Ltd |

| NSR | National Storage REIT |

| NST | Northern Star Resources Ltd |

| NTO | Nitro Software Ltd |

| NUF | Nufarm Ltd |

| NVX | Novonix Ltd |

| NWH | NRW Holdings Ltd |

| NWL | Netwealth Group Ltd |

| NWS | News Corporation |

| NXL | NUIX Ltd |

| NXT | NEXTDC Ltd |

| OBL | Omni Bridgeway Ltd |

| OCA | Oceania Healthcare Ltd |

| OCL | Objective Corporation Ltd |

| OMH | Om Holdings Ltd |

| OML | Ooh!Media Ltd |

| OPH | Ophir High Conviction Fund |

| OPT | Opthea Ltd |

| ORA | Orora Ltd |

| ORE | Orocobre Ltd |

| ORG | Origin Energy Ltd |

| ORI | Orica Ltd |

| OSH | Oil Search Ltd |

| OZL | OZ Minerals Ltd |

| PAI | Platinum Asia Investments Ltd |

| PAR | Paradigm Biopharmaceuticals Ltd |

| PBH | Pointsbet Holdings Ltd |

| PCI | Perpetual Credit Income Trust |

| PDL | Pendal Group Ltd |

| PDN | Paladin Energy Ltd |

| PGF | PM Capital Global Opportunities Fund Ltd |

| PGG | Partners Group Global Income Fund |

| PGH | Pact Group Holdings Ltd |

| PL8 | Plato Income Maximiser Ltd |

| PLL | Piedmont Lithium Ltd |

| PLS | Pilbara Minerals Ltd |

| PMC | Platinum Capital Ltd |

| PME | Pro Medicus Ltd |

| PMGOLD | Gold |

| PMV | Premier Investments Ltd |

| PNI | Pinnacle Investment Management Group Ltd |

| PNV | Polynovo Ltd |

| PPC | Peet Ltd |

| PPE | People Infrastructure Ltd |

| PPH | Pushpay Holdings Ltd |

| PPK | PPK Group Ltd |

| PPS | Praemium Ltd |

| PPT | Perpetual Ltd |

| PRN | Perenti Global Ltd |

| PRU | Perseus Mining Ltd |

| PSI | PSC Insurance Group Ltd |

| PSQ | Pacific Smiles Group Ltd |

| PTM | Platinum Asset Management Ltd |

| PWG | Primewest |

| PWH | PWR Holdings Ltd |

| PYC | PYC Therapeutics Ltd |

| QAN | Qantas Airways Ltd |

| QBE | QBE Insurance Group Ltd |

| QPON | Betashares Australian Bank Senior Floating Rate Bond ETF |

| QRI | Qualitas Real Estate Income Fund |

| QUAL | Vaneck Vectors MSCI World Ex Australia Quality ETF |

| QUB | QUBE Holdings Ltd |

| RAC | Race Oncology Ltd |

| RBD | Restaurant Brands New Zealand Ltd |

| RBL | Redbubble Ltd |

| RDC | Redcape Hotel Group |

| REA | REA Group Ltd |

| RED | RED 5 Ltd |

| REG | Regis Healthcare Ltd |

| REH | Reece Ltd |

| RF1 | Regal Investment Fund |

| RFF | Rural Funds Group |

| RHC | Ramsay Health Care Ltd |

| RIO | RIO Tinto Ltd |

| RMC | Resimac Group Ltd |

| RMD | Resmed Inc |

| RMS | Ramelius Resources Ltd |

| RRL | Regis Resources Ltd |

| RSG | Resolute Mining Ltd |

| RWC | Reliance Worldwide Corporation Ltd |

| S32 | SOUTH32 Ltd |

| SBM | ST Barbara Ltd |

| SCG | Scentre Group |

| SCP | Shopping Centres Australasia Property Group |

| SDF | Steadfast Group Ltd |

| SEK | Seek Ltd |

| SFR | Sandfire Resources Ltd |

| SFY | SPDR S&P/ASX 50 Fund |

| SGF | SG Fleet Group Ltd |

| SGLLV | Ricegrowers Ltd |

| SGM | Sims Ltd |

| SGP | Stockland |

| SGR | The Star Entertainment Group Ltd |

| SHL | Sonic Healthcare Ltd |

| SHV | Select Harvests Ltd |

| SIG | Sigma Healthcare Ltd |

| SIQ | Smartgroup Corporation Ltd |

| SKC | Skycity Entertainment Group Ltd |

| SKI | Spark Infrastructure Group |

| SKO | Serko Ltd |

| SLC | Superloop Ltd |

| SLF | SPDR S&P/ASX 200 Listed Property Fund |

| SLK | Sealink Travel Group Ltd |

| SLR | Silver Lake Resources Ltd |

| SM1 | Synlait Milk Ltd |

| SNZ | Summerset Group Holdings Ltd |

| SOL | Washington H Soul Pattinson & Company Ltd |

| SPK | Spark New Zealand Ltd |

| SPL | Starpharma Holdings Ltd |

| SSM | Service Stream Ltd |

| SSR | SSR Mining Inc |

| STO | Santos Ltd |

| STW | SPDR S&P/ASX 200 Fund |

| STX | Strike Energy Ltd |

| SUL | Super Retail Group Ltd |

| SUN | Suncorp Group Ltd |

| SVW | Seven Group Holdings Ltd |

| SWM | Seven West Media Ltd |

| SXL | Southern Cross Media Group Ltd |

| SXY | SENEX Energy Ltd |

| SYD | Sydney Airport |

| SYR | Syrah Resources Ltd |

| SZL | Sezzle Inc |

| TAH | Tabcorp Holdings Ltd |

| TCL | Transurban Group |

| TGR | Tassal Group Ltd |

| TLG | Talga Group Ltd |

| TLS | Telstra Corporation Ltd |

| TLT | Tilt Renewables Ltd |

| TLX | TELIX Pharmaceuticals Ltd |

| TNE | Technology One Ltd |

| TPG | TPG Telecom Ltd |

| TPW | Temple & Webster Group Ltd |

| TWE | Treasury Wine Estates Ltd |

| TYR | Tyro Payments Ltd |

| UMG | United Malt Group Ltd |

| UNI | Universal Store Holdings Ltd |

| UOS | United Overseas Australia Ltd |

| URW | Unibail-Rodamco-Westfield |

| UWL | Uniti Group Ltd |

| VACF | Vanguard Australian Corp Fixed Interest INDEX ETF |

| VAF | Vanguard Australian Fixed Interest INDEX ETF |

| VAP | Vanguard Australian Property Securities INDEX ETF |

| VAS | Vanguard Australian Shares INDEX ETF |

| VCX | Vicinity Centres |

| VDBA | Vanguard Diversified Balanced INDEX ETF |

| VDGR | Vanguard Diversified Growth INDEX ETF |

| VDHG | Vanguard Diversified High Growth INDEX ETF |

| VEA | Viva Energy Group Ltd |

| VEU | Vanguard All-World Ex-US Shares INDEX ETF |

| VG1 | Vgi Partners Global Investments Ltd |

| VG8 | Vgi Partners Asian Investments Ltd |

| VGAD | Vanguard MSCI INDEX International Shares (Hedged) ETF |

| VGB | Vanguard Australian Government Bond INDEX ETF |

| VGE | Vanguard Ftse Emerging Markets Shares ETF |

| VGI | VGI Partners Ltd |

| VGL | Vista Group International Ltd |

| VGS | Vanguard MSCI INDEX International Shares ETF |

| VHY | Vanguard Australian Shares High Yield ETF |

| VIF | Vanguard International Fixed Interest INDEX (Hedged) ETF |

| VOC | Vocus Group Ltd |

| VRT | Virtus Health Ltd |

| VSO | Vanguard MSCI Australian Small Companies INDEX ETF |

| VTS | Vanguard US Total Market Shares INDEX ETF |

| VUK | Virgin Money Uk Plc |

| VUL | Vulcan Energy Resources Ltd |

| WAF | West African Resources Ltd |

| WAM | WAM Capital Ltd |

| WBC | Westpac Banking Corporation |

| WEB | Webjet Ltd |

| WES | Wesfarmers Ltd |

| WGB | Wam Global Ltd |

| WGN | Wagners Holding Company Ltd |

| WGX | Westgold Resources Ltd |

| WHC | Whitehaven Coal Ltd |

| WHF | Whitefield Ltd |

| WLE | Wam Leaders Ltd |

| WMI | Wam Microcap Ltd |

| WOR | Worley Ltd |

| WOW | Woolworths Group Ltd |

| WPL | Woodside Petroleum Ltd |

| WPP | WPP AUNZ LtdSuspended |

| WPR | Waypoint REIT |

| WSA | Western Areas Ltd |

| WSP | Whispir Ltd |

| WTC | Wisetech Global Ltd |

| XARO | Activex Ardea Real Outcome Bond Fund (Managed Fund) |

| XRO | Xero Ltd |

| YAL | Yancoal Australia Ltd |

| Z1P | ZIP Co Ltd |

| ZEL | Z Energy Ltd |

| ZIM | Zimplats Holdings Ltd |

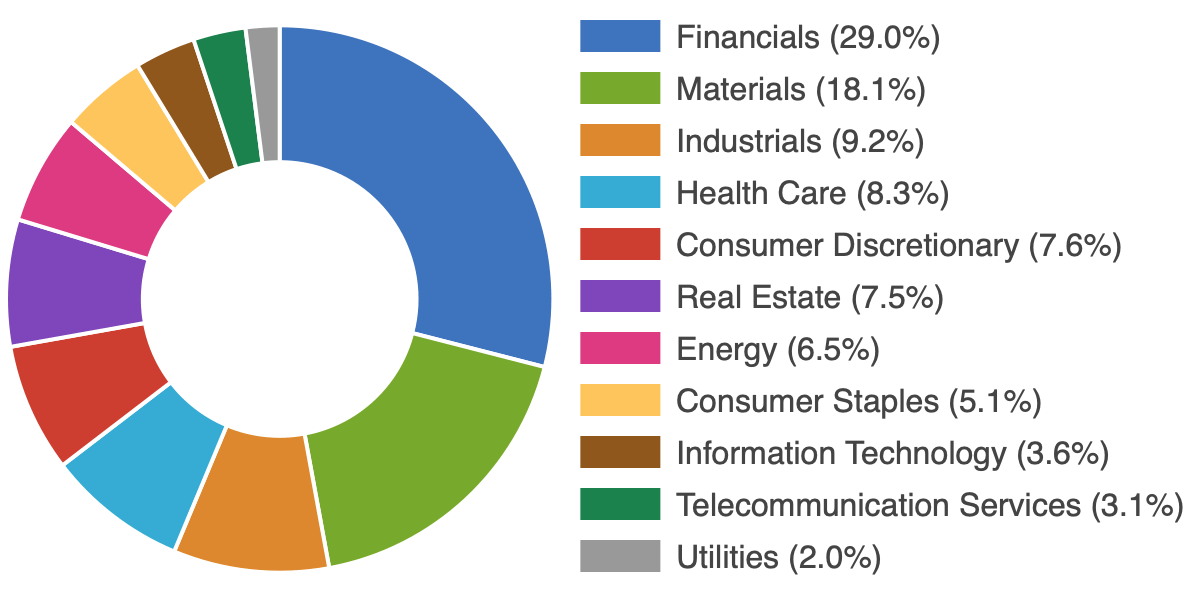

Sector breakdown

All S&P/ASX Indices use the Global Industry Classification Standard (GICS) to categorise constituents according to their principal business activity.

Data updated: 1 March 2019

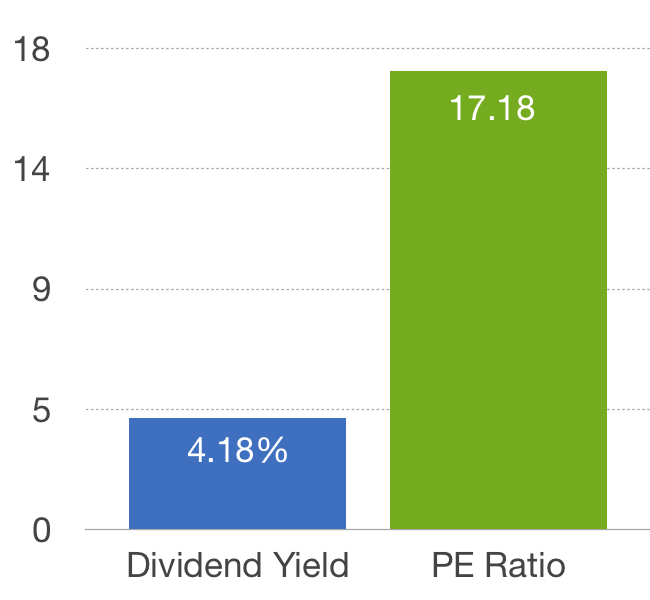

PE Ratio & Dividend Yield

Fundamental data for the All Ordinaries Index is weight-adjusted by market capitalisation. Companies with zero or negative values are ignored.

Data updated: 1 July 2017

Exchange Traded Fund (ETF)

ETFs are managed funds that track a benchmark. They trade on the ASX like ordinary shares using their ticker code. The goal of an index fund is to replicate the performance of the underlying index, less fees and expenses.

As at 17 July 2017, there are no ETFs that track the performance of the All Ordinaries Index.